- #Moneyspire vs banktivity for free#

- #Moneyspire vs banktivity for mac#

- #Moneyspire vs banktivity upgrade#

- #Moneyspire vs banktivity full#

- #Moneyspire vs banktivity windows 10#

#Moneyspire vs banktivity for mac#

The Mac version of Quicken has lagged behind the Windows version for years and even though Quicken 2019 For Mac was an improvement, the decision to make Quicken subscription only was the final straw for many faithful users.

#Moneyspire vs banktivity for free#

You can seamlessly move from Fortora Fresh Finance to Moneyspire without losing your data, and you qualify not only to receive Moneyspire 2016, but also Moneyspire 2017 for free when it is released in the 4th quarter of 2016.If you’ve finally had it with Quicken, we’ve taken a closer look at the best personal finance software for Mac of 2023 that make excellent alternatives to Quicken for Mac.

#Moneyspire vs banktivity windows 10#

This means the software now supports all the latest Mac features such as full-screen support, faster performance and support for the upcoming OS X El Capitan.Ĥ) Enhanced Windows 10 support for Microsoft Windows customers.ĥ) Released a Linux version (So now we support all 3 major desktop platforms).

#Moneyspire vs banktivity upgrade#

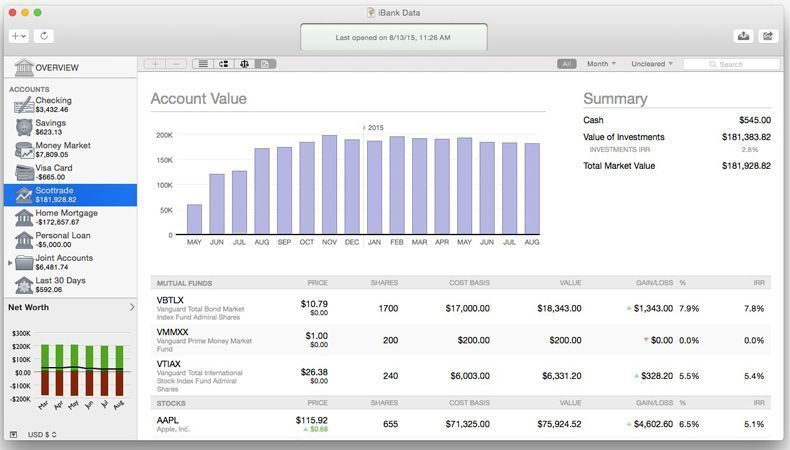

A new version will be released every year, and you can upgrade if you want, but you won't be required to.ģ) Converted the Mac version from a Carbon to Cocoa application. “1) The software is no longer offered as a subscription. If Moneyspire would impove their Reminders, I would be even happier to abandon Chronicle too… Im still waiting for Moneyspire to improve their MoneyspireGo app and Im all set and happy. qif file exprted from iBank and everythings looks clean and neat). Im so glad that I can finally abandon iBank (now days Banktivity) especially because I do not like my finances to be sitting on anybodies server (Moneyspire so precisely imported my. One of my requests was (and still IS) to keep local wi-fi syncing with iOS (they responded to my message thanking me for my comment). They were contacting the previous FFF owners and they have asked to give them a feedback about the new ideas for Moneyspire that users would like to see.

#Moneyspire vs banktivity full#

Moneyspire replaced my FFF for free of charge as promised (see bellow the full list of what was promised and so far to my knowledge they have met those targets). When Moneyspire acquired Fortora Fresh Finance last Sept. With Moneyspire you have the choice to keep your data local on your computer if you want to.

Set bill reminders and see all your upcoming payments so you never forget to pay a bill again.

Balance your checkbook and keep your accounts in order. and see all your account balances in one place.

0 kommentar(er)

0 kommentar(er)